I work with people who are concerned they have not planned for the last quarter of their life and help them overcome that fear and build a path to achieve their desires.

STEPHEN DYER, CFP ®

FOUNDER

The financial planning team at Optimal Wealth Strategies brings with it a

multitude of experience. Each member possesses a unique competency that

combines to provide a comprehensive estate and financial planning solution.

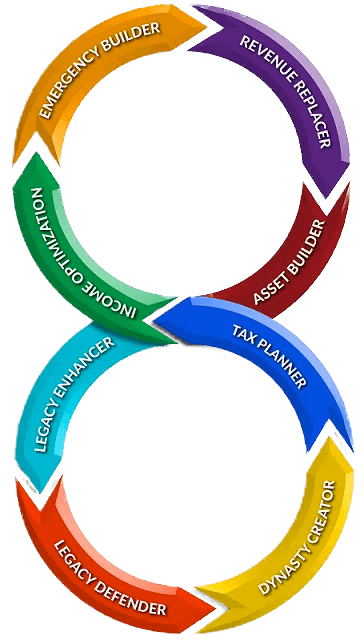

8 ELEMENTS OF FINANCIAL CONTROL

A goal without

a plan is just

a wish.

Emergency Builder

Liquidity is important for those unexpected yet expected events. Not having enough emergency funds can cause inefficiencies in your investments and income if those emergencies are having to be taken care of out of them.

Revenue Replacer

Revenue Replacer looks at what happens when sources of income are lost. This may be the loss of pension, social security, and other sources of income when a loved one passes away. It’s important to have a strategy in place to replace that income, so that the lifestyle going forward isn’t compromised.

Income Optimizer

Income is the foundation of a financial plan. Income optimization makes sure you’re taking income the most tax efficient way. It also ensures that you have enough guaranteed income source for certainty in your financial life. Predictable income allows you to be spontaneous with your lifestyle for the things you enjoy doing, and living the retirement you dreamed of.

Asset Builder

Once you have your income optimized and you know that you have your income and where their sources are coming from, you have your emergency builder set up so you have liquidity. You have your revenue replacer taken care of so you’re taking care of your loved ones. Now’s the time to start to finally start building your assets, not just for short-term and long-term. Using the asset builder process, we are able to structure assets strategically utilizing intelligent portfolio design hoping to enhance the most amount, or get the most amount of your money that’s possible.

Legacy Enhancer

Legacy Enhancer focuses on growing your assets for your future, and those that you want to leave your money to. The right balance of risk and reward can be found by developing an investment policy statement for your financial plan to ensure you’re not taking on too much risk, and that your goals can have a higher likelihood of success.

Tax Planner

With tax planning everyone understands that whether you pay $5 or $50,000 to the IRS, everyone loathes paying money to the tax world. Realizing that taxes are a fee that can have a negative income, not just short term, but also long term with your investment plan is very serious business. During the tax planner module we look to see how taxes impact everything. All the way from your income, to your assets, to your estate, and your legacy. We stress the tax importance so people understand the net rate of return for their investments rather than the gross.

Legacy Defender

Legacy Defense is important for protecting your money from other people. You’ve worked hard to get where you are. We live in a litigious society. This analyzes where your investments & assets might be vulnerable to lawsuits and creditors & then makes recommendations on how better to protect yourself.

Dynasty Creator

Dynasty Creator assesses where your estate is now, and how better to optimize what you leave behind. It’s not only important what you leave behind, but how you leave it. There are 3 places your assets can go when you pass: Your Loved Ones, Charities, & the IRS. No one wants to leave it to the IRS. A properly structured financial plan will include legacy strategies to leave assets the most tax efficient way.

Our Services

Financial Planning

Retirement Income

When developing a retirement plan there is much more to think about besides saving money. 401(k)’s, IRA’s,Life Insurance, Annuities and Trusts all can be combined to make sure that you have enough money to retire on and that your money is protected.

Investment Management

At Optimal Wealth Strategies, we believe no two investors are alike. Therefore, in order to help each client meet their financial goals, we base our process on a client-focused, personalized approach using multiple investment strategies.

Legacy Planning

Throughout your life you have worked extremely hard to create a secure financial future for your family and loved ones. It is critical that you take the proper steps necessary to conserve your estate and financial security after you pass away.

Tax Planning

CONTACT US

Investment Advisory services provided by individuals as Investment Advisory Representatives of Motiv8 Investments, LLC, a Registered Investment Adviser. Motiv8 Investments does not provide insurance, tax, or estate planning services. Such services, if provided, are provided by individuals affiliated with Motiv8 Investments in their separately licensed capacities.